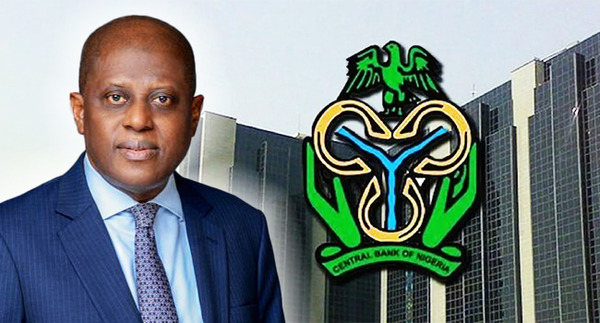

The governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, has disclosed that Nigeria’s foreign reserve has risen to over $46 billion.

Cardoso revealed this during the opening of the Monetary Policy Department’s 20th anniversary colloquium in Abuja on Tuesday morning.

Cardoso, who was represented by the Deputy Governor Economic Policy Directorate, Dr. Muhammad Abdullahi, stated that it was the first time the country reached such a level since 2018 and that it could cover over 10 months of imports.

The deputy governor has indicated that lending rates may decline in the coming months, a forecast tied to the continued easing of inflation. This development is expected to foster improved access to credit and stimulate stronger investment flows.

Read Also

Data published by the Central Bank of Nigeria (CBN) showed that the naira depreciated marginally by 0.4 percent as the dollar was quoted at N1,448.03 on Monday, compared to N1,442.43 on Friday at the Nigerian Foreign Exchange Market (NFEM).

READ ALSO: CBN Eases Interest Rate to 27%, Lowers CRR For Banks

In the parallel market, the naira gained slightly by N2, closing at N1,455 on Monday as against N1,457 on Friday.

Nigeria’s external reserves have reached $46.7 billion. This significant milestone is largely attributed to the government’s Eurobond issuance and a surge in overall foreign exchange (FX) inflows.

October 2025 was the strongest month for FX inflows since May, driven by enhanced macroeconomic stability and renewed interest from offshore investors.

In contrast to rising FX inflows, Foreign Direct Investment (FDI) inflows declined by 25% month-on-month to $222 million.