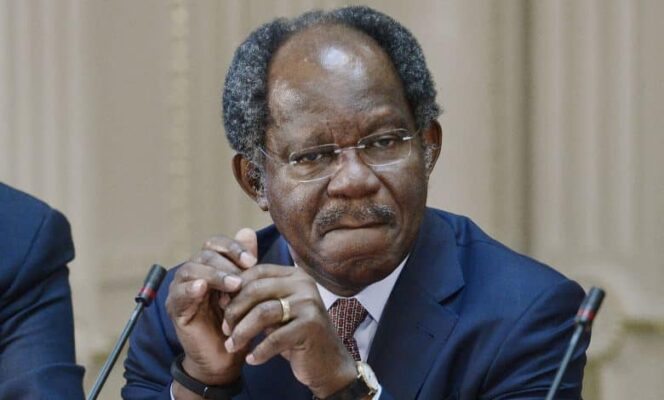

Bayo Ogunlesi, Chairman of Global Infrastructure Partners (GIP), has expressed optimism about Nigeria’s investment climate, confirming plans by his firm to deepen its footprint in the country.

Speaking to journalists after a private meeting with President Bola Tinubu at the State House, Ogunlesi said Nigeria is becoming an increasingly attractive destination for global capital.

“We’re making investments in Nigeria. We explored additional opportunities. I’m not going to tell you what they are. Just wait, watch this space, you will see them,” he said.

He described the meeting with President Tinubu as productive and forward-looking, particularly on how to position Nigeria for greater international investment inflows.

“But look, Nigeria is now a place that is exciting to invest in, and that’s what we talked to Mr. President about. And of course, as you would expect, he was very encouraging of international investments in Nigeria,” Ogunlesi added.

The GIP chairman praised recent economic reforms introduced by the Tinubu administration, noting that they have laid a foundation for investor confidence.

“Think about it. Removal of subsidy, tax reform, we have a refinery that’s operating and exporting aviation fuel, unification of the road ownership system, and so the next step is how do we encourage international investment in Nigeria to drive economic growth,” he said.

READ ALSO: Shettima Showcases Nigeria’s $200bn Energy Transition To Global Investors

Reflecting on the meeting, Ogunlesi said both sides shared ideas on how to put Nigeria “front and centre” on the global investment map.

“And I had a wonderful meeting with Mr. President, exchanging ideas about how we can do that, how we can put Nigeria — front and centre — on the map for international investments. And we had some very good suggestions and discussions about that.”

Ogunlesi also hinted at GIP’s broader sectoral interests, indicating that its existing investments in global energy could inform future commitments in Nigeria’s natural gas and aviation sectors.

“So we invest in energy, we’re building LNG plants in Texas, we’re building LNG plants in Australia. There’s gas in Nigeria,” he said.

“Nigeria is a huge gas province. People describe me as a guy who bought Gatwick Airport. I didn’t personally buy Gatwick Airport.”

He added that the aviation sector is also “an area of interest” for his company, leaving open the possibility of future infrastructure investments in Nigeria’s airports or related logistics systems.