Special Adviser to President Bola Tinubu on Policy Communication, Daniel Bwala, has called for a broader understanding of Nigeria’s evolving tax system.

Bwala made the remarks during a live interview on TVC’s Breakfast Show, where he stressed the importance of public education, government accountability, and infrastructural development in the ongoing tax reform discussions.

Drawing a comparison with the United Kingdom, Bwala highlighted how taxation can lead to tangible public benefits when managed effectively.

“In England, they tax people and then provide free newspapers,” he explained.

“If you live in the heart of London and you commute regularly, you’ll see people handing out free newspapers. That’s because someone was taxed for that service. Someone who loves reading will understand and appreciate the value of that tax.”

He pointed out that those who fail to recognise the connection between taxation and public services often view taxes only in terms of personal inconvenience.

“Somebody who does not like reading might say, ‘Na newspaper I go chop?’ –dismissing the initiative entirely. But that’s the problem when people don’t understand the dynamics of taxation, they only react to the immediate impact on their finances,” Bwala said.

Bwala, who also runs a law firm, acknowledged that he too will feel the effects of any tax changes. However, he emphasised the need to focus on what the government intends to do with the revenue generated.

“I run a law office. I have staff. We pay our taxes and have done so for years. Of course, we’ll be impacted. But my confidence lies in what the government is able to do with that revenue across all levels,” he said.

Read Also

He referenced ongoing government efforts in infrastructure development and security as signs of intent and progress.

“Recently, we released funds for various projects aimed at improving infrastructure and enabling free trade. Investments have also been made in the security sector to ensure that Nigerians can live and do business safely whether they’re farmers, tech professionals, or entrepreneurs in other sectors.”

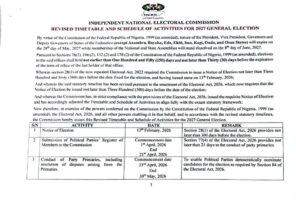

Read Also:Sweeping Reforms Are Being Implemented For Electoral Integrity – Bwala

Bwala stressed that economic development cannot happen without adequate infrastructure. He used the example of road travel between Abuja and Gwagwalada to highlight how bad roads increase transportation costs, while proper investment in infrastructure, funded through taxes, could ultimately lower those costs.

“If the road is bad, the cost of traveling from here to Gwagwalada increases. But if we invest in fixing that road through taxes, the cost goes down. That’s how the economic cycle works,” he explained.

He also pointed out that the new tax regime is not being imposed arbitrarily. According to him, the federal government conducted extensive consultations with stakeholders before rolling out the reforms.

“This tax policy was not decided in isolation. There were town halls and wide-ranging consultations. Now, what’s left is for us to educate the public on the benefits.”

Bwala maintained that the impact of the new policy will not be uniform. Some individuals, particularly those in lower income brackets, could even see a reduction in their tax burden.

“It’s not everybody that will suffer. For some people, from January, it will feel like heaven – they’ll be exempted from taxes in some areas. Even those who still pay will likely pay less.

The federal government’s proposed tax reforms are part of its broader economic strategy aimed at boosting internally generated revenue while ensuring equitable distribution of public resources.