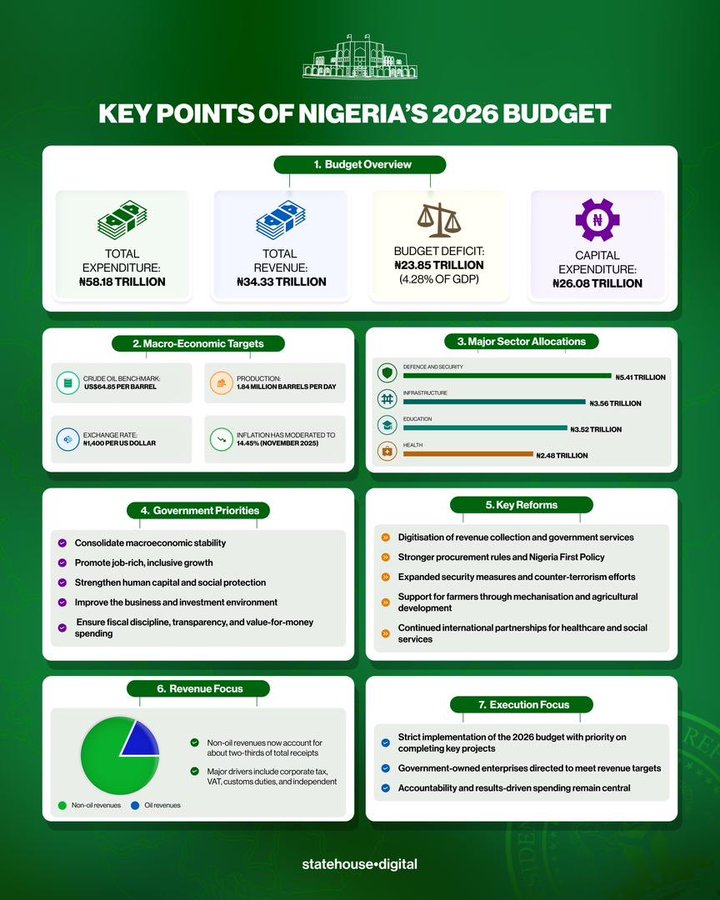

President Bola Ahmed Tinubu’s proposed N58.18 trillion 2026 budget represents a consolidation phase in Nigeria’s reform cycle—less about shock policies, more about stabilising gains, restoring confidence and institutionalising resilience.

Below are 15 analytical takeaways from the spending plan.

1. Scale signals government confidence

At N58.18 trillion, the budget reflects confidence in revenue recovery from oil output improvements, tax reforms and tighter fiscal controls, despite ongoing macroeconomic pressures.

2. From reform to consolidation

The theme—Consolidation, Renewed Resilience and Shared Prosperity—signals a shift from disruptive reforms to embedding outcomes and managing social impact.

3. Security anchors the entire framework

Security spending is not treated as a standalone line item but as the foundation upon which economic recovery, investment and social stability depend.

4. Military modernisation over manpower expansion

The focus is on equipment upgrades, logistics, mobility and operational readiness rather than sheer troop numbers.

5. Policing shifts towards intelligence and technology

Funding priorities indicate a move from reactive policing to intelligence-led, tech-enabled security operations, including surveillance and data integration.

6. Infrastructure positioned as growth multiplier

Roads, rail, power and logistics infrastructure are framed as productivity enablers rather than welfare spending.

7. Education spending targets workforce quality

Allocations emphasise skills, access and institutional capacity—aligning education funding with labour market needs.

8. Health viewed as economic infrastructure

Healthcare investment is tied to productivity, labour participation and national resilience, not just social protection.

9. Integrated human capital strategy

The budget explicitly links security, health and education as mutually reinforcing drivers of growth.

10. Subnational governments remain central

Targeted support to states reflects recognition that service delivery and security outcomes depend heavily on state-level capacity.

11. Revenue realism underpins ambition

Projected spending rests on improved oil production discipline, non-oil revenue mobilisation and tax administration reforms.

12. Stronger emphasis on fiscal discipline

Leakage reduction, expenditure tracking and value-for-money frameworks remain core to budget credibility.

13. Targeted social protection over blanket subsidies

Social spending is designed to cushion vulnerable groups while avoiding broad, distortionary subsidies.

14. Private sector confidence as a policy metric

Budget success is partly measured by its ability to crowd in private investment and sustain job creation.

15. Renewed Hope Agenda enters execution phase

The 2026 budget marks a transition from vision-setting to delivery, with success dependent on implementation discipline.