President Bola Ahmed Tinubu has declared that Nigeria is stronger financially and experiencing reduced corruption as a result of his administration’s economic reforms introduced over the past two years.

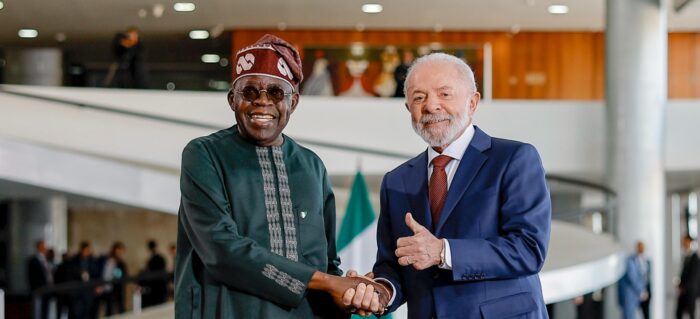

Speaking in Brazil, the President told investors that his government’s decisions — including the removal of fuel subsidies and the liberalisation of the foreign exchange market — had curbed currency speculation, boosted revenues and created a more competitive business environment.

“The reforms I’ve embarked upon since I took over in Nigeria have been very impactful. It was initially painful, but today the result is blossoming,” Tinubu said. “It’s getting clearer to the people. We have more money for the economy, no more corruption.”

Fuel subsidies, which were scrapped in 2023, had cost the country an estimated ₦10 trillion, while multiple exchange rates allowed a few elites to profit from arbitrage at the expense of the wider economy.

The reforms, considered some of the toughest since 1986, triggered the worst cost-of-living crisis in decades. Inflation surged to multi-year highs and the naira lost more than 70 per cent of its value, pushing millions deeper into poverty.

That pressure has started to ease. Headline inflation fell to 21.88 per cent in July, a four-month low, while the naira has stabilised after months of volatility. Government revenues have also risen sharply, with the Federation Account Allocation Committee (FAAC) disbursing ₦12.08 trillion between January and July 2024 — about 78 per cent of the ₦15.45 trillion generated federally.

Yet, the impact on households remains severe. World Bank data shows that 129 million Nigerians — more than half of the population — now live below the poverty line. A government cash transfer programme aimed at 15 million vulnerable citizens has so far reached just 36 per cent of intended beneficiaries, according to PwC.

The naira’s devaluation has also seen Nigeria slip from Africa’s largest economy to fourth place. Even after a GDP rebasing, the economy expanded by only 30 per cent to $243 billion.