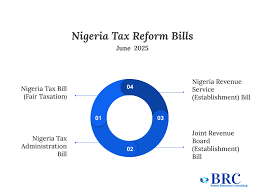

Nigeria’s tax landscape has undergone sweeping reforms following the enactment of the Nigerian Tax Administration Act 2025, which consolidates and modernises tax laws while introducing new rates, levies and compliance mechanisms.

The Act, which replaces key provisions of the Companies Income Tax Act, Personal Income Tax Act, Capital Gains Tax Act and other fiscal laws, signals the biggest overhaul of the country’s tax system in decades. It also establishes the Nigeria Revenue Service (NRS), replacing the Federal Inland Revenue Service (FIRS), to improve collection efficiency and reduce duplication among agencies.

Under the new law, small companies with annual turnover of ₦100 million or less and fixed assets not exceeding ₦250 million are exempt from corporate income tax (CIT), capital gains tax (CGT) and the new Development Levy. In contrast, larger firms will continue to pay the standard rates, including a new 4 per cent Development Levy on assessable profits which replaces several previous sectoral levies.

Individuals also stand to benefit from more generous thresholds. Those earning ₦800,000 or less annually, after reliefs, are now exempt from personal income tax, while new marginal rates up to 25 per cent have been introduced for higher earners.

The Act also raises capital gains tax for companies from 10 per cent to 30 per cent and brings into the tax net a broader range of assets, including indirect share transfers, cryptocurrencies and intangible assets.

A major innovation is the introduction of a minimum effective tax rate of 15 per cent for large companies with turnover of at least ₦50 billion or for multinationals that shift profits abroad. Companies that fall below this threshold will be subject to a “top-up” payment.

Value Added Tax remains at 7.5 per cent but has been restructured to allow wider zero-rating on essentials such as food, healthcare and education. Full input VAT credits are now available on services and capital expenditure, while electronic invoicing and mandatory digital filing have been introduced to close compliance gaps.

The new tax code also simplifies the levy structure by merging multiple charges – including the Tertiary Education Tax, IT levy, Police Trust Fund levy and NASENI levy – into the single 4 per cent Development Levy.

According to tax experts, the reforms are aimed at improving fairness, transparency and compliance while giving relief to low-income earners and small businesses. “This Act represents a shift to a more streamlined and equitable system, but it also signals tougher enforcement for larger companies and multinationals,” a Lagos-based tax consultant told our correspondent.

The Federal Government says the Nigerian Tax Administration Act 2025 is designed to align the country’s fiscal system with global best practices, boost revenues and improve investor confidence.