Investment has been described as the Lifeblood that the Nigerian Economy needs to grow and give Nigeria the Shared prosperity that develops a nation.

Fiscal Policy Partner and Africa Tax Leader of Price WaterHouse Coopers, Taiwon Oyedele, made thsi disclosure while featuring on the TVC News premier Business Programme, Business Nigeria.

Mr Oyedele who was speaking on the 58.98% drop in Foreign Direct Investment into the Nigerian Economy between 2010 and 2021 said every nation and its Economy needs investment to grow.

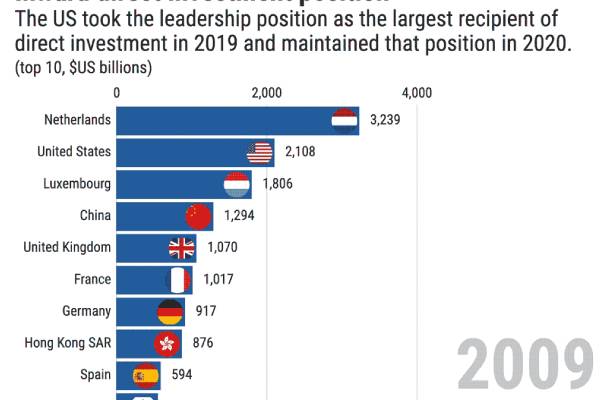

He added that the United States of America which has the biggest Economy in the World and the most developed by far on all indices also attracts the highest Foreign Direct Investment in the World.

He said investment will aid any nations’ ability to generate employment, growth, the ability for government to be able to raise revenue, the ability to enhance infrastructure development, the ability for human capital development and Others that are all catalysts for Economic Development.

He added that Nigeria needs even more development and that in the last ten years Foreign Direct Investment across the World has increased tremendously.

According to him the Organisation for Economic Cooperation and Development, OECD, in its report said Foreign Direct Investment around the World increased by 20% in the first quarter of 2022.

He however said its unfortunate that as Investment increases around the World their is a corresponding decline in Investment in Nigeria which has to be that factors peculiar to Nigeria are stopping investment from flowing into the Country.

He disclosed that the nation needs to take a closer look at laws and regulations in place across the nation.

He disclosed that Nigeria is also losing out on portfolio investment which is a good source of liquidity.

He said domestic investment mobilisation in the Local Economy even by Nigerians is not sufficient enough to fund development and Economic growth.

He added that deliberate action needs to be taken to encourage both Local and Foreign Direct Investment disclosing that the Capital Market is just about 50 Billion Dollars.

He said all Other countries have been attracting Foreign Direct Investment wondering why Nigeria is not getting the same corresponding inflow despite the same setbacks that Others have faced across the World.

He called for clear and realistic Policy environment for investors to invest and be able to make their money back including profits and all.

Going Further he said the failure of government to be able to put in place policies, laws and regulations that will protect investment is a major drawback for investors.

He disclosed that until Investors are able to get a stable policy environment which will guarantee them Risk Adjusted Returns they will no longer put money into Nigeria.

This according to him led to downgrading of Nigeria as an investment destination making the investment from abroad a mirage.

Investment has been described as the Lifeblood that the Nigerian Economy needs to grow and give Nigeria the Shared prosperity that develops a nation.

Fiscal Policy Partner and Africa Tax Leader of Price WaterHouse Coopers, Taiwon Oyedele, made thsi disclosure while featuring on the TVC News premier Business Programme, Business Nigeria.

Mr Oyedele who was speaking on the 58.98% drop in Foreign Direct Investment into the Nigerian Economy between 2010 and 2021 said every nation and its Economy needs investment to grow.

He added that the United States of America which has the biggest Economy in the World and the most developed by far on all indices also attracts the highest Foreign Direct Investment in the World.

He said investment will aid any nations’ ability to generate employment, growth, the ability for government to be able to raise revenue, the ability to enhance infrastructure development, the ability for human capital development and Others that are all catalysts for Economic Development.

He added that Nigeria needs even more development and that in the last ten years Foreign Direct Investment across the World has increased tremendously.

According to him the Organisation for Economic Cooperation and Development, OECD, in its report said Foreign Direct Investment around the World increased by 20% in the first quarter of 2022.

He however said its unfortunate that as Investment increases around the World their is a corresponding decline in Investment in Nigeria which has to be that factors peculiar to Nigeria are stopping investment from flowing into the Country.

He disclosed that the nation needs to take a closer look at laws and regulations in place across the nation.

He disclosed that Nigeria is also losing out on portfolio investment which is a good source of liquidity.

He said domestic investment mobilisation in the Local Economy even by Nigerians is not sufficient enough to fund development and Economic growth.

He added that deliberate action needs to be taken to encourage both Local and Foreign Direct Investment disclosing that the Capital Market is just about 50 Billion Dollars.

He said all Other countries have been attracting Foreign Direct Investment wondering why Nigeria is not getting the same corresponding inflow despite the same setbacks that Others have faced across the World.

He called for clear and realistic Policy environment for investors to invest and be able to make their money back including profits and all.

Going Further he said the failure of government to be able to put in place policies, laws and regulations that will protect investment is a major drawback for investors.

He disclosed that until Investors are able to get a stable policy environment which will guarantee them Risk Adjusted Returns they will no longer put money into Nigeria.

This according to him led to downgrading of Nigeria as an investment destination making the investment from abroad a mirage.

Investment has been described as the Lifeblood that the Nigerian Economy needs to grow and give Nigeria the Shared prosperity that develops a nation.

Fiscal Policy Partner and Africa Tax Leader of Price WaterHouse Coopers, Taiwon Oyedele, made thsi disclosure while featuring on the TVC News premier Business Programme, Business Nigeria.

Mr Oyedele who was speaking on the 58.98% drop in Foreign Direct Investment into the Nigerian Economy between 2010 and 2021 said every nation and its Economy needs investment to grow.

He added that the United States of America which has the biggest Economy in the World and the most developed by far on all indices also attracts the highest Foreign Direct Investment in the World.

He said investment will aid any nations’ ability to generate employment, growth, the ability for government to be able to raise revenue, the ability to enhance infrastructure development, the ability for human capital development and Others that are all catalysts for Economic Development.

He added that Nigeria needs even more development and that in the last ten years Foreign Direct Investment across the World has increased tremendously.

According to him the Organisation for Economic Cooperation and Development, OECD, in its report said Foreign Direct Investment around the World increased by 20% in the first quarter of 2022.

He however said its unfortunate that as Investment increases around the World their is a corresponding decline in Investment in Nigeria which has to be that factors peculiar to Nigeria are stopping investment from flowing into the Country.

He disclosed that the nation needs to take a closer look at laws and regulations in place across the nation.

He disclosed that Nigeria is also losing out on portfolio investment which is a good source of liquidity.

He said domestic investment mobilisation in the Local Economy even by Nigerians is not sufficient enough to fund development and Economic growth.

He added that deliberate action needs to be taken to encourage both Local and Foreign Direct Investment disclosing that the Capital Market is just about 50 Billion Dollars.

He said all Other countries have been attracting Foreign Direct Investment wondering why Nigeria is not getting the same corresponding inflow despite the same setbacks that Others have faced across the World.

He called for clear and realistic Policy environment for investors to invest and be able to make their money back including profits and all.

Going Further he said the failure of government to be able to put in place policies, laws and regulations that will protect investment is a major drawback for investors.

He disclosed that until Investors are able to get a stable policy environment which will guarantee them Risk Adjusted Returns they will no longer put money into Nigeria.

This according to him led to downgrading of Nigeria as an investment destination making the investment from abroad a mirage.

Investment has been described as the Lifeblood that the Nigerian Economy needs to grow and give Nigeria the Shared prosperity that develops a nation.

Fiscal Policy Partner and Africa Tax Leader of Price WaterHouse Coopers, Taiwon Oyedele, made thsi disclosure while featuring on the TVC News premier Business Programme, Business Nigeria.

Mr Oyedele who was speaking on the 58.98% drop in Foreign Direct Investment into the Nigerian Economy between 2010 and 2021 said every nation and its Economy needs investment to grow.

He added that the United States of America which has the biggest Economy in the World and the most developed by far on all indices also attracts the highest Foreign Direct Investment in the World.

He said investment will aid any nations’ ability to generate employment, growth, the ability for government to be able to raise revenue, the ability to enhance infrastructure development, the ability for human capital development and Others that are all catalysts for Economic Development.

He added that Nigeria needs even more development and that in the last ten years Foreign Direct Investment across the World has increased tremendously.

According to him the Organisation for Economic Cooperation and Development, OECD, in its report said Foreign Direct Investment around the World increased by 20% in the first quarter of 2022.

He however said its unfortunate that as Investment increases around the World their is a corresponding decline in Investment in Nigeria which has to be that factors peculiar to Nigeria are stopping investment from flowing into the Country.

He disclosed that the nation needs to take a closer look at laws and regulations in place across the nation.

He disclosed that Nigeria is also losing out on portfolio investment which is a good source of liquidity.

He said domestic investment mobilisation in the Local Economy even by Nigerians is not sufficient enough to fund development and Economic growth.

He added that deliberate action needs to be taken to encourage both Local and Foreign Direct Investment disclosing that the Capital Market is just about 50 Billion Dollars.

He said all Other countries have been attracting Foreign Direct Investment wondering why Nigeria is not getting the same corresponding inflow despite the same setbacks that Others have faced across the World.

He called for clear and realistic Policy environment for investors to invest and be able to make their money back including profits and all.

Going Further he said the failure of government to be able to put in place policies, laws and regulations that will protect investment is a major drawback for investors.

He disclosed that until Investors are able to get a stable policy environment which will guarantee them Risk Adjusted Returns they will no longer put money into Nigeria.

This according to him led to downgrading of Nigeria as an investment destination making the investment from abroad a mirage.

Investment has been described as the Lifeblood that the Nigerian Economy needs to grow and give Nigeria the Shared prosperity that develops a nation.

Fiscal Policy Partner and Africa Tax Leader of Price WaterHouse Coopers, Taiwon Oyedele, made thsi disclosure while featuring on the TVC News premier Business Programme, Business Nigeria.

Mr Oyedele who was speaking on the 58.98% drop in Foreign Direct Investment into the Nigerian Economy between 2010 and 2021 said every nation and its Economy needs investment to grow.

He added that the United States of America which has the biggest Economy in the World and the most developed by far on all indices also attracts the highest Foreign Direct Investment in the World.

He said investment will aid any nations’ ability to generate employment, growth, the ability for government to be able to raise revenue, the ability to enhance infrastructure development, the ability for human capital development and Others that are all catalysts for Economic Development.

He added that Nigeria needs even more development and that in the last ten years Foreign Direct Investment across the World has increased tremendously.

According to him the Organisation for Economic Cooperation and Development, OECD, in its report said Foreign Direct Investment around the World increased by 20% in the first quarter of 2022.

He however said its unfortunate that as Investment increases around the World their is a corresponding decline in Investment in Nigeria which has to be that factors peculiar to Nigeria are stopping investment from flowing into the Country.

He disclosed that the nation needs to take a closer look at laws and regulations in place across the nation.

He disclosed that Nigeria is also losing out on portfolio investment which is a good source of liquidity.

He said domestic investment mobilisation in the Local Economy even by Nigerians is not sufficient enough to fund development and Economic growth.

He added that deliberate action needs to be taken to encourage both Local and Foreign Direct Investment disclosing that the Capital Market is just about 50 Billion Dollars.

He said all Other countries have been attracting Foreign Direct Investment wondering why Nigeria is not getting the same corresponding inflow despite the same setbacks that Others have faced across the World.

He called for clear and realistic Policy environment for investors to invest and be able to make their money back including profits and all.

Going Further he said the failure of government to be able to put in place policies, laws and regulations that will protect investment is a major drawback for investors.

He disclosed that until Investors are able to get a stable policy environment which will guarantee them Risk Adjusted Returns they will no longer put money into Nigeria.

This according to him led to downgrading of Nigeria as an investment destination making the investment from abroad a mirage.

Investment has been described as the Lifeblood that the Nigerian Economy needs to grow and give Nigeria the Shared prosperity that develops a nation.

Fiscal Policy Partner and Africa Tax Leader of Price WaterHouse Coopers, Taiwon Oyedele, made thsi disclosure while featuring on the TVC News premier Business Programme, Business Nigeria.

Mr Oyedele who was speaking on the 58.98% drop in Foreign Direct Investment into the Nigerian Economy between 2010 and 2021 said every nation and its Economy needs investment to grow.

He added that the United States of America which has the biggest Economy in the World and the most developed by far on all indices also attracts the highest Foreign Direct Investment in the World.

He said investment will aid any nations’ ability to generate employment, growth, the ability for government to be able to raise revenue, the ability to enhance infrastructure development, the ability for human capital development and Others that are all catalysts for Economic Development.

He added that Nigeria needs even more development and that in the last ten years Foreign Direct Investment across the World has increased tremendously.

According to him the Organisation for Economic Cooperation and Development, OECD, in its report said Foreign Direct Investment around the World increased by 20% in the first quarter of 2022.

He however said its unfortunate that as Investment increases around the World their is a corresponding decline in Investment in Nigeria which has to be that factors peculiar to Nigeria are stopping investment from flowing into the Country.

He disclosed that the nation needs to take a closer look at laws and regulations in place across the nation.

He disclosed that Nigeria is also losing out on portfolio investment which is a good source of liquidity.

He said domestic investment mobilisation in the Local Economy even by Nigerians is not sufficient enough to fund development and Economic growth.

He added that deliberate action needs to be taken to encourage both Local and Foreign Direct Investment disclosing that the Capital Market is just about 50 Billion Dollars.

He said all Other countries have been attracting Foreign Direct Investment wondering why Nigeria is not getting the same corresponding inflow despite the same setbacks that Others have faced across the World.

He called for clear and realistic Policy environment for investors to invest and be able to make their money back including profits and all.

Going Further he said the failure of government to be able to put in place policies, laws and regulations that will protect investment is a major drawback for investors.

He disclosed that until Investors are able to get a stable policy environment which will guarantee them Risk Adjusted Returns they will no longer put money into Nigeria.

This according to him led to downgrading of Nigeria as an investment destination making the investment from abroad a mirage.

Investment has been described as the Lifeblood that the Nigerian Economy needs to grow and give Nigeria the Shared prosperity that develops a nation.

Fiscal Policy Partner and Africa Tax Leader of Price WaterHouse Coopers, Taiwon Oyedele, made thsi disclosure while featuring on the TVC News premier Business Programme, Business Nigeria.

Mr Oyedele who was speaking on the 58.98% drop in Foreign Direct Investment into the Nigerian Economy between 2010 and 2021 said every nation and its Economy needs investment to grow.

He added that the United States of America which has the biggest Economy in the World and the most developed by far on all indices also attracts the highest Foreign Direct Investment in the World.

He said investment will aid any nations’ ability to generate employment, growth, the ability for government to be able to raise revenue, the ability to enhance infrastructure development, the ability for human capital development and Others that are all catalysts for Economic Development.

He added that Nigeria needs even more development and that in the last ten years Foreign Direct Investment across the World has increased tremendously.

According to him the Organisation for Economic Cooperation and Development, OECD, in its report said Foreign Direct Investment around the World increased by 20% in the first quarter of 2022.

He however said its unfortunate that as Investment increases around the World their is a corresponding decline in Investment in Nigeria which has to be that factors peculiar to Nigeria are stopping investment from flowing into the Country.

He disclosed that the nation needs to take a closer look at laws and regulations in place across the nation.

He disclosed that Nigeria is also losing out on portfolio investment which is a good source of liquidity.

He said domestic investment mobilisation in the Local Economy even by Nigerians is not sufficient enough to fund development and Economic growth.

He added that deliberate action needs to be taken to encourage both Local and Foreign Direct Investment disclosing that the Capital Market is just about 50 Billion Dollars.

He said all Other countries have been attracting Foreign Direct Investment wondering why Nigeria is not getting the same corresponding inflow despite the same setbacks that Others have faced across the World.

He called for clear and realistic Policy environment for investors to invest and be able to make their money back including profits and all.

Going Further he said the failure of government to be able to put in place policies, laws and regulations that will protect investment is a major drawback for investors.

He disclosed that until Investors are able to get a stable policy environment which will guarantee them Risk Adjusted Returns they will no longer put money into Nigeria.

This according to him led to downgrading of Nigeria as an investment destination making the investment from abroad a mirage.

Investment has been described as the Lifeblood that the Nigerian Economy needs to grow and give Nigeria the Shared prosperity that develops a nation.

Fiscal Policy Partner and Africa Tax Leader of Price WaterHouse Coopers, Taiwon Oyedele, made thsi disclosure while featuring on the TVC News premier Business Programme, Business Nigeria.

Mr Oyedele who was speaking on the 58.98% drop in Foreign Direct Investment into the Nigerian Economy between 2010 and 2021 said every nation and its Economy needs investment to grow.

He added that the United States of America which has the biggest Economy in the World and the most developed by far on all indices also attracts the highest Foreign Direct Investment in the World.

He said investment will aid any nations’ ability to generate employment, growth, the ability for government to be able to raise revenue, the ability to enhance infrastructure development, the ability for human capital development and Others that are all catalysts for Economic Development.

He added that Nigeria needs even more development and that in the last ten years Foreign Direct Investment across the World has increased tremendously.

According to him the Organisation for Economic Cooperation and Development, OECD, in its report said Foreign Direct Investment around the World increased by 20% in the first quarter of 2022.

He however said its unfortunate that as Investment increases around the World their is a corresponding decline in Investment in Nigeria which has to be that factors peculiar to Nigeria are stopping investment from flowing into the Country.

He disclosed that the nation needs to take a closer look at laws and regulations in place across the nation.

He disclosed that Nigeria is also losing out on portfolio investment which is a good source of liquidity.

He said domestic investment mobilisation in the Local Economy even by Nigerians is not sufficient enough to fund development and Economic growth.

He added that deliberate action needs to be taken to encourage both Local and Foreign Direct Investment disclosing that the Capital Market is just about 50 Billion Dollars.

He said all Other countries have been attracting Foreign Direct Investment wondering why Nigeria is not getting the same corresponding inflow despite the same setbacks that Others have faced across the World.

He called for clear and realistic Policy environment for investors to invest and be able to make their money back including profits and all.

Going Further he said the failure of government to be able to put in place policies, laws and regulations that will protect investment is a major drawback for investors.

He disclosed that until Investors are able to get a stable policy environment which will guarantee them Risk Adjusted Returns they will no longer put money into Nigeria.

This according to him led to downgrading of Nigeria as an investment destination making the investment from abroad a mirage.