First City Monument Bank has issued an alert for accounts owned by people aged 18 to 30, advising employees to keep an eye out for money launderers and other criminal activity.

The Central Bank of Nigeria has banned cryptocurrency trading in the country, according to an internal email obtained by Peoples Gazette titled “Compliance Advisory on Cryptocurrency Dealing/Transactions.”

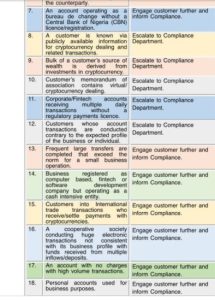

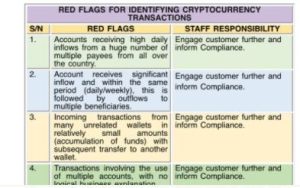

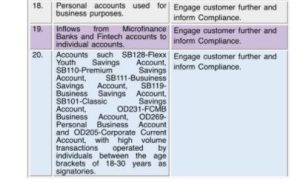

Accounts “with high volume transactions operated by individuals between the age brackets of 18-30 years as signatories,” should be flagged for possible fraudulent activities by staff members, the memo said.

Youth savings accounts, corporate savings accounts, and personal business accounts are just a few of the account kinds with discriminatory rules. Although the bank did not specify what constitutes a high volume of transactions, the account types listed encompassed all of the bank’s available packages for Nigerian youths.

The internal email advised employees to keep an eye on the mentioned accounts for red signals “in order to keep the Bank safe and secure against criminals, organized gangs, money launderers, and terrorist financiers.”

After the CBN ordered all Nigerian commercial banks to freeze the accounts of certain individuals for allegedly trading in cryptocurrencies, this compliance advisory was issued. A Post-No-Debit directive issued by the banking sector regulator listed two persons, Nnamdi Francis Okereke and Nwaorgu Kingsley Chibuzor, as well as a company, TVS Hallmark Service Limited, according to the Gazette.

However, the FCMB’s memo signified the latest escalation in the CBN’s directive’s execution. Section 42 of the Nigerian Constitution forbids any form of discrimination against citizens. FCMB did not respond to phone calls or e-mails seeking comment on the leaked message to staff members.

Other banks may have implemented similar problematic rules against young people, but CBN spokesman Osita Nwanisobi said banks were not ordered to enforce the cryptocurrency prohibition on the basis of age or other types of discrimination.