The single forex exchange policy of the Tinubu administration has generated significant interest and debate in Nigeria. The policy aims to streamline the country’s foreign exchange system, unify multiple exchange rates, and promote transparency and efficiency in the allocation of foreign currency.

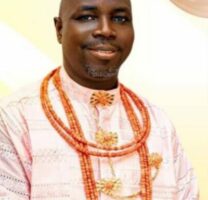

In this article, TVC News Senior Executive, Digital and Social Media, Wasiu examines the potential impact of this policy on Nigeria’s economy, considering its benefits, challenges, and implications for various sectors.

Enhanced Economic Stability:

The implementation of a single forex exchange policy can contribute to greater economic stability in Nigeria. Currently, the existence of multiple exchange rates has led to distortions, arbitrage opportunities, and a lack of transparency. By unifying the exchange rates, the policy can reduce currency speculation, curb capital flight, and attract foreign investment. This stability will provide a solid foundation for economic growth and development.

Boosting Investor Confidence:

A transparent and efficient forex exchange system will enhance investor confidence in Nigeria’s economy. Foreign investors are often deterred by complex and opaque exchange rate mechanisms. With a single forex exchange policy, investors can expect a more predictable and level playing field, reducing uncertainty and promoting investment inflows. Increased foreign direct investment (FDI) can stimulate economic growth, create job opportunities, and bolster various sectors such as manufacturing, infrastructure, and technology.

Strengthening Local Industries:

The single forex exchange policy has the potential to strengthen local industries and encourage domestic production. Currently, some industries face challenges due to limited access to foreign currency at favorable rates, hindering their ability to import essential raw materials and machinery. A unified exchange rate would provide a fair and accessible platform for businesses, enabling them to import necessary inputs, enhance productivity, and compete effectively both domestically and internationally.

Read Also

Mitigating Inflationary Pressures:

In Nigeria, multiple exchange rates have contributed to inflationary pressures. The existence of divergent rates encourages round-tripping and speculative activities, leading to a depreciation in the value of the local currency. By adopting a single forex exchange policy, the government can better manage inflation by reducing currency volatility, controlling money supply, and stabilizing prices. This will have a positive impact on the purchasing power of consumers and improve overall economic well-being.

Addressing Fiscal Deficit:

A unified forex exchange policy can help address Nigeria’s fiscal deficit. The current system allows for potential leakages and inefficient allocation of foreign exchange, which can strain the country’s finances. With a transparent and streamlined forex market, the government can better allocate its limited resources, optimize revenue generation, and reduce the pressure on foreign reserves. This fiscal discipline will contribute to long-term economic sustainability and reduce dependency on external borrowing.

Challenges and Considerations:

Implementing a single forex exchange policy is not without its challenges. The transition process requires careful planning, stakeholder engagement, and effective communication. The policy’s success depends on building trust among market participants, addressing concerns about exchange rate volatility, and ensuring adequate liquidity in the forex market. Additionally, managing the potential impact on sectors heavily reliant on imports, such as fuel, may require targeted interventions to prevent price shocks and social unrest.

Conclusion:

President Tinubu’s proposed single forex exchange policy has the potential to transform Nigeria’s economy by promoting stability, attracting investments, strengthening local industries, mitigating inflationary pressures, and addressing fiscal deficits. However, its successful implementation will require robust planning, effective communication, and stakeholder collaboration. By streamlining the forex market, Nigeria can create a more transparent and efficient system that stimulates economic growth, improves investor confidence, and sets the stage for a prosperous future.